Blog

The role of the central bank in a digitalising world

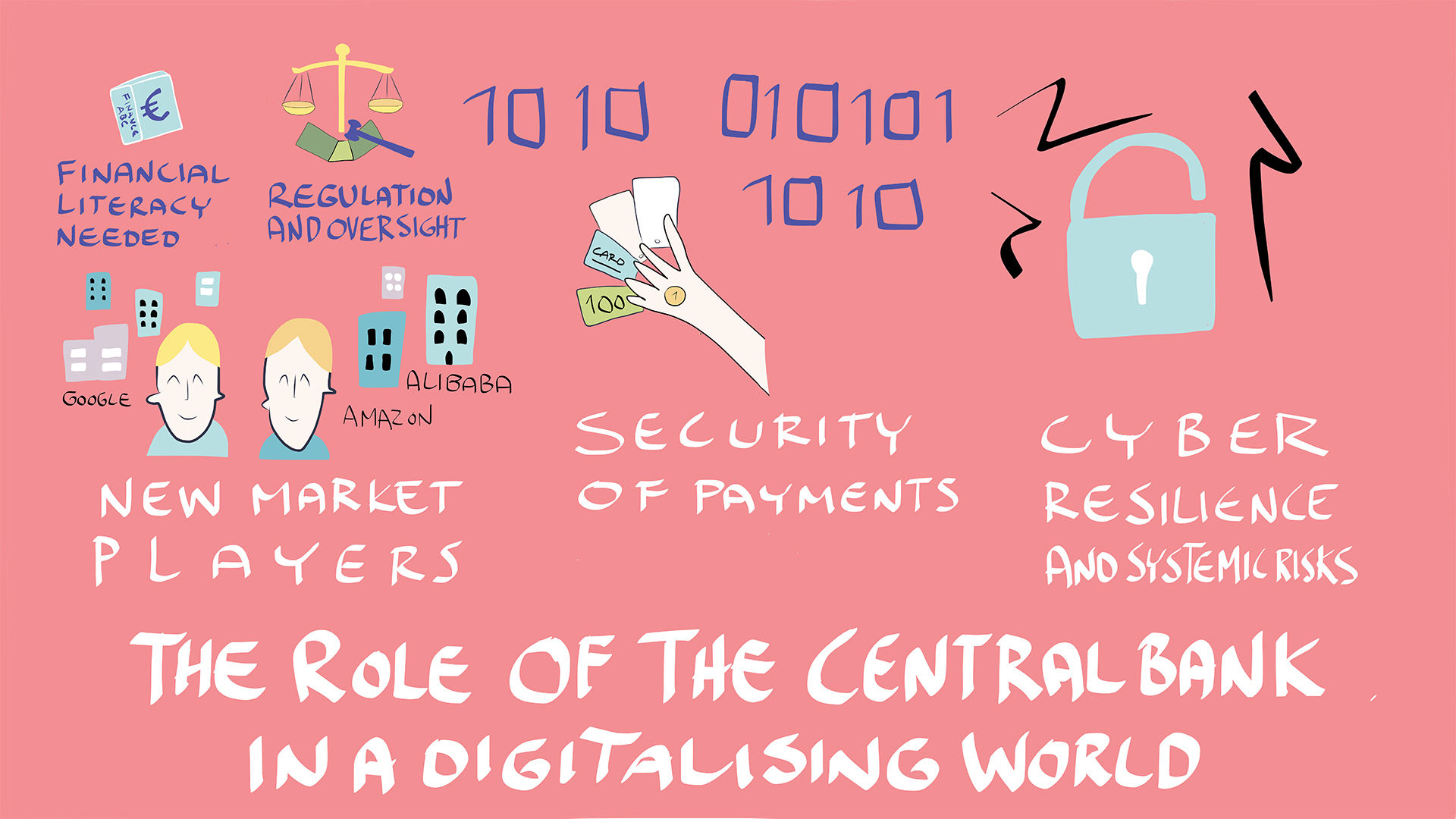

Digitalisation holds great promise for new opportunities, but it will also usher in new challenges and risks. Businesses will enjoy lower operating costs and consumers a wider breadth of choice, while cross-sector and cross-border competition will both increase. Service providers will need to make determined efforts and investments in order to keep up amidst the technological change and intensified competition. Regulatory changes will also spur the digital transformation of payments. The revised Payment Services Directive (PSD2) entered into force in early 2018, and its effects are gradually being felt. As payments become quicker and are increasingly relegated to the background of purchase transactions, greater demands will be placed on personal finance skills and financial literacy.

Authorities must actively monitor the financial market's structural transformation, maintain financial stability, and do their part in ensuring that the use of digital financial services is safe and reliable. It is important to assist in the development of the financial sector by lending support to promising innovations. To ensure a fair and uniform operating environment, entities who offer similar products or services ought to be subject to the same rules and regulatory oversight.

Could cash turn digital?

For the individual consumer, the financial industry's digital transformation will be most evident in the nature of payments. Payment methods have proliferated as a variety of mobile applications have joined the ranks of card payment and cash. The Bank of Finland is tasked with the general oversight of payment and settlement systems. In this capacity, the Bank actively researches new payment methods as well as technologies which may impact existing payment systems.

Several national central banks, including the Bank of Finland, are currently investigating whether there is reason to introduce a digital payment instrument alongside, but similar to, cash for use by the general public. This is subject to comprehensive review, however, and will not affect current payment methods in the immediate years ahead. If trials involving the use of the digital cash were to take place within the Eurosystem, the decision of such a trial would be taken together.

Although the use of cash has decreased in recent years and card payment has become the most popular form of retail payment, banknotes and coins are in no danger of disappearing soon. Cash still has qualities that digital alternatives struggle to replicate. For one, cash does not require a functioning network connection.

Systemic risk and cyber threats must be addressed

The proliferation and adoption of new technologies will place greater demands on cyber resilience. Information security has traditionally concentrated on the role of the organisation, focusing on measures such as antivirus protection, software updates and data backups. Moving forwards, more attention needs to be placed on containing systemic risks that threaten the entire financial system which may arise from these new technologies, products and services. Interconnectedness and interdependencies between different service providers and geographical regions will grow. It is essential that no single vulnerability risks disrupting the entire financial system. Moreover, robust data protection is required to protect against leaks and tampering.

In the event of possible disruption, Finland must possess the capability to maintain independent control over its critical infrastructures, such as, for example, payment systems that are used to transfer wages, pensions and business invoicing. Payment and settlement systems must function under all circumstances to prevent the economy from becoming disrupted.

A national back-up system for payment transfers should be put into place, one that could be deployed in emergency situations without the need of international assistance. The Bank of Finland collaborates on issues related to national preparedness with other authorities and select entities from the financial sector. Together, the objective is to develop a framework which guarantees the operational integrity of all critical infrastructures that are also shared by financial markets.