Blog

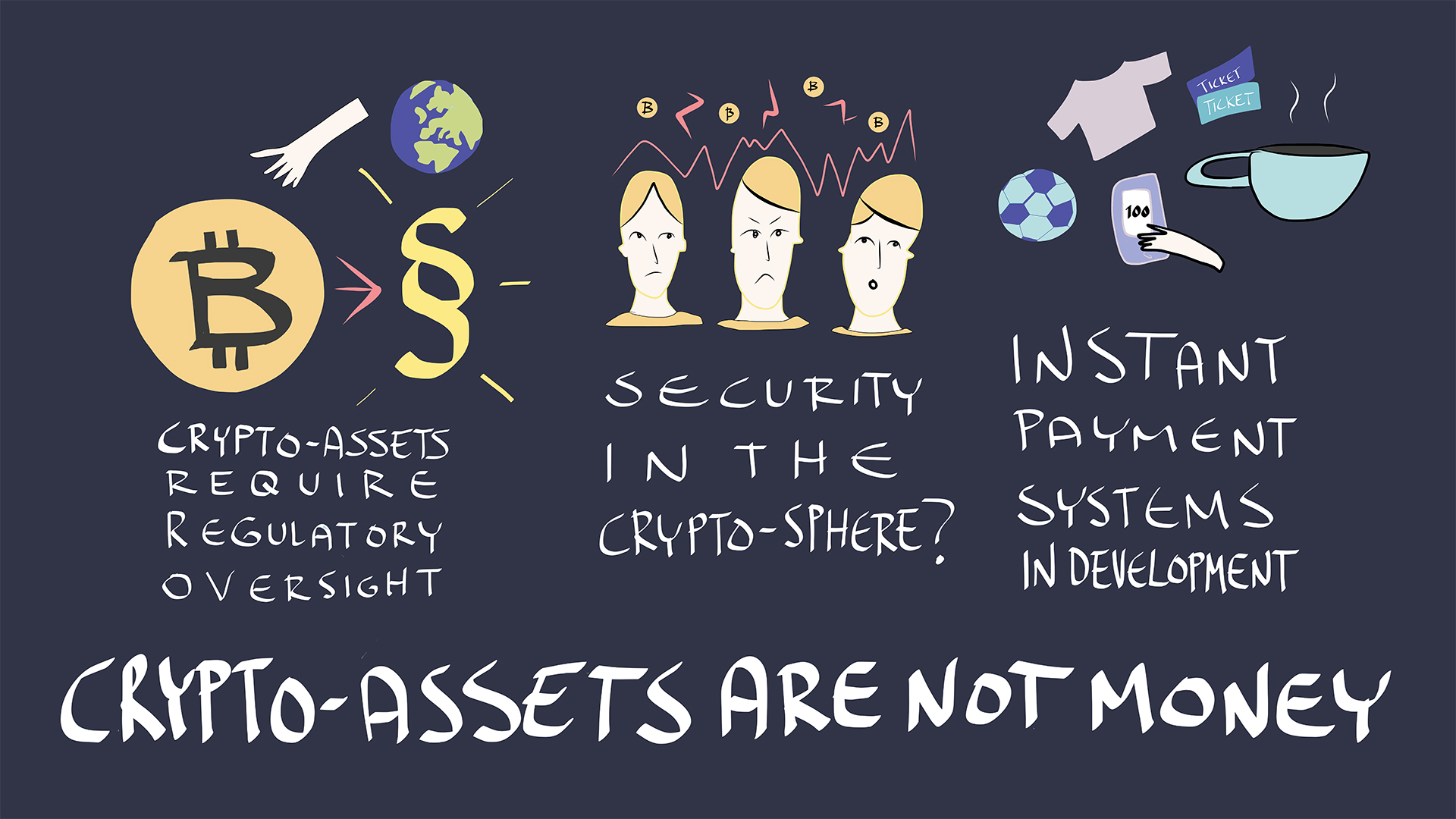

Crypto-assets are not money

Cryptocurrency fails to satisfy the properties of money

Cryptocurrencies refer to virtual mediums of exchange, which are transferred from one holder to another without the use of a centralised ledger. Originally conceived as an alternative to the official monetary system, cryptocurrencies have failed to realise their intended purpose. Instead, they might be viewed as an asset class of sorts, but only as long as there is a functioning market for them. As such, it is more appropriate to speak of crypto-assets, not cryptocurrencies.

In practice, crypto-assets are seldom used as a means of payment but have instead gained traction as a speculative asset. For investors, crypto-assets are laden with risks, such as extreme price volatility. In addition, crypto-assets are subject to large transaction costs and other fees. For these reasons, crypto-assets do not constitute a realistic alternative to money. New payment systems and mobile applications are far superior means for providing cost-efficient and instantaneous credit transfers and retail payments, undoubtedly so compared to crypto-assets.

Crypto-assets must be subject to regulatory oversight

Financial market regulation must also address the novel operating models associated with digitalisation. Looking ahead, a variety of issues must be addressed, such as uncertainty surrounding material interests where comprehensive ownership information is unavailable.

Management of crypto-assets has gradually been consolidated by large commercial entities, such as exchanges and electronic wallets. If and when they manage customer assets, they should be subject to regulatory oversight. International efforts to create common rules surrounding crypto-assets should be intensified. Joint efforts are required to address issues such as tax evasion.

Ideally, the regulation of crypto-assets would be global. The EU's regulatory framework not only protects the internal market but has positive reverberations beyond the union itself. For example, the Payment Services Directive (PSD2) and the General Data Protection Regulation (GDPR) are studied world-wide. Legislation is continuously adapted to meet the standards of new technologies and evolving markets.

Blockchain technology still in its infancy

The Bank of Finland is not only tasked with maintaining the reliability and efficiency of payment systems and other financial infrastructures; it also actively participates in their development. In maintaining central bank services, the Bank of Finland seeks to provide a safe and reliable operating environment for the economy’s critical functions. New technologies should actively be sought out and implemented when they support the central bank’s mission.

The Bank of Finland has joined other Eurosystem national central banks in evaluating blockchain and other distributed-ledger technologies. In their current state, these technologies do not satisfy the requirements placed on central bank service infrastructures. Instead, central banks are pursuing other means to enhance their infrastructures, such as by implementing instant payment systems.